California remains one of the state's most vital, exciting, and competitive markets in the United States. The year-over-year change in single-family home sales is projected to jump 10.5% in 2025 to 304,400 units. The average price of a single-family home that's already built is likely to appreciate 4.6% to $909,400 in 2025.

Beginning condominium and townhouse sales are forecasted to total 52,500 units in 2025. Such trends indicate a booming market with increasing demand, creating immense opportunities for fix-and-flip investors who must up their game to pocket highly profitable transactions.

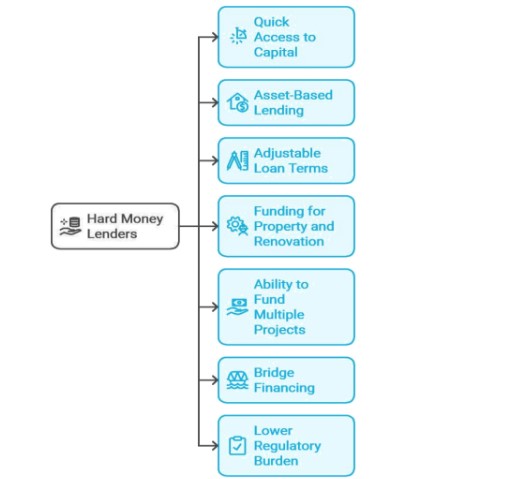

With the prevailing momentum in the market, hard money lenders in California offer crucial support to fix-and-flip investors through fast, flexible financing that traditional lenders can hardly compete with. Here are the key reasons hard money lenders California enter the fix-and-flip market in California.

Why Hard Money Lenders in California Are Perfectly Suitable For Fix-and-Flip Investors

Alt text - benefits of hard money lenders

-

Quick Access to Capital

California is a hot market with pretty properties selling faster than a bagel at a New York deli. Hard money loans get approved and funded within three to five business days. Traditional bank loans take 30+ days to fund. So, one has the security of locking in a property before other investors do so. The enormous competitive edge is quick access to capital.

-

Asset-Based Lending: Focuses on value in property rather than credit end

Since hard money loans focus on the property's value, they are much less strict regarding credit scores and financial documentation an investor can provide. This makes the asset-based approach rather beneficial for fix-and-flip investors who hope to pad property value through renovations - property equity takes center stage over the borrower's financial history.

This asset-based loan model is very effective for fix-and-flip investors who would otherwise not qualify for traditional loans but can draw on property equity. Focusing on the worth of

property implies that hard money lenders in California open the opportunity doors to a more diverse range of investors, from the sophisticated professional to the beginner in the real estate market.

-

Adjustable Loan Terms Designed for Projects

Unlike regular banks, hard money lenders are much more flexible to the needs of each project. Many hard money lenders in California allow investors flexibility in loan structure, accommodating unique timelines, renovation budgets, and exit strategies. Standard options include interest only for the duration of the renovation period and repayment schedules that are feasible and aligned with project cash flows.

-

Funding includes both Property and Renovation

At times, with hard money loans, one can cover the costs of both the purchase price and renovation, meaning the investor may be able to fund one project with a loan. This is particularly helpful for fix-and-flip projects, whereby the cost of renovation on a property increases its market value.

-

Ability to Fund Multiple Projects at Once

Because of the speed and flexibility of hard money lending, investors can juggle multiple fix-and-flip projects at once, a complicated and cumbersome feat within the framework of traditional bank financing because of stricter requirements and longer times to approval. Hard money lending is ideally suited for investors looking to diversify their portfolios and capitalize on multiple opportunities in California's market.

It is particularly beneficial to astute investors looking to accelerate their portfolio growth since they can simultaneously finance a range of projects. Using hard money funding, additional properties may be acquired even before those being renovated or sold are finalized for a maximum profit across different investments.

-

Bridge Financing to Keep Investment Momentum

Hard money loans often provide a bridge, giving the investor a potential property well before selling an existing one. That creates enough momentum to keep up with market opportunities and not disrupt cash flow or miss a deal.

-

Lower regulatory burden for a more straightforward process

Traditional lenders have several restrictions and a much more stringent regulatory procedure, which may take longer. Hard money lenders have fewer such restrictions. This allows them to approve these loans based on property value with greater flexibility in their bureaucratic framework. Reduced regulatory burdens for fix-and-flip investors mean quick access to liquid funds for the property.

Loans from the best hard money lenders in California depend on a simplified process based on the potential value that the property might give. Thus, one can access the capital without an elaborate check on the credit status or much documentation. This streamlined loan is perfect for projects where time is of the essence.

Final Thoughts

The fix-and-flip investor in California is not interested in traditional financing methods, where hard money lenders play a role. With fast access to capital, flexible terms, asset-based qualifications, and smooth processes, it's become perfect for the fast-paced nature of this market. Sure, the hard money loan rates in California are higher, but with effective management, the benefits outweigh the costs.

Providing funding solutions to investors, Munshi.Biz is an excellent choice for the best hard money lenders in California. Partnering with a trusted hard money lender opens the possibility of securing more California properties quickly and funding renovations easily, making the most of California's dynamic real estate market.